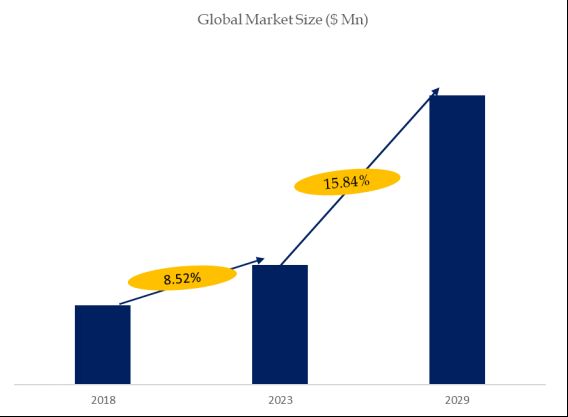

Third-party Mobile Payment Research:CAGR of 15.84% during the forecast period

Third-party Mobile Payment Market Summary

Third-party mobile payment refers to a financial transaction where a third-party service provider facilitates the transfer of funds between two parties, typically a consumer and a merchant, using a mobile device. These transactions are conducted through mobile payment platforms or apps provided by third-party companies that are not directly affiliated with the financial institutions involved in the transaction. Third-party mobile payment services have become increasingly popular due to their convenience, speed, and accessibility.

According to the new market research report "Global Third-party Mobile Payment Market Report 2023-2029", published by QYResearch, the global Third-party Mobile Payment market size is projected to grow from USD 9,074,912.56 million in 2023 to USD 21,927,733.38 million by 2029, at a CAGR of 15.84% during the forecast period.

- Global Third-party Mobile Payment MarketSize(US$ Million), 2018-2029

Above data is based on report from QYResearch: Global Third-party Mobile Payment Market Report 2023-2029 (published in 2023). If you need the latest data, plaese contact QYResearch.

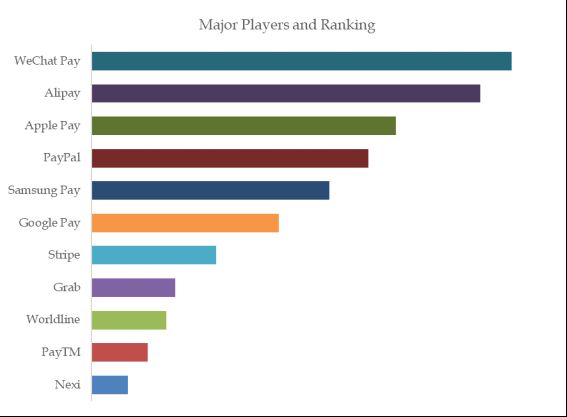

- Global Third-party Mobile Payment Top11Players Ranking and Market Share (Ranking is based on the revenue of 2023, continually updated)

Above data is based on report from QYResearch: Global Third-party Mobile Payment Market Report 2023-2029 (published in 2023). If you need the latest data, plaese contact QYResearch.

This report profiles key players of Third-party Mobile Payment such as WeChat Pay, Alipay, Apple Pay, PayPal, Samsung Pay。

In 2023, the global top five Third-party Mobile Payment players account for 56.65% of market share in terms of revenue.

Market Drivers:

Convenience and Accessibility: Third-party mobile payment solutions offer a convenient and accessible way for users to make transactions. Users can make payments, transfer funds, and conduct financial transactions from their mobile devices at any time and from anywhere.

Contactless Payments: The emphasis on contactless payment methods, especially in response to public health concerns, has accelerated the adoption of third-party mobile payment services. Users can make payments without physical contact with cards or cash, promoting a safer and more hygienic transaction experience.

E-commerce Growth: The rise of e-commerce and online shopping has fueled the demand for seamless and secure payment options. Third-party mobile payment solutions are often integrated into e-commerce platforms, providing users with a convenient and efficient way to make online purchases.

Restraint:

Security Concerns: Security remains a significant concern for users adopting third-party mobile payment services. Instances of data breaches, fraud, and cyber threats may create hesitancy among users, particularly if they are uncertain about the safety of their financial information.

Lack of Standardization: The absence of standardized protocols for mobile payments can hinder interoperability and create fragmentation in the market. Different third-party providers may have varying technologies and processes, making it challenging for users to seamlessly transact across different platforms.

Limited Acceptance at Merchants: While acceptance of third-party mobile payments has grown, it is not universal. Some merchants may not support certain mobile payment providers, limiting the places where users can make transactions using these services.

Opportunity:

Global Expansion: There is significant potential for third-party mobile payment providers to expand their services globally. By entering new markets and forming strategic partnerships, providers can tap into diverse user bases and cater to the growing demand for digital payment solutions on a global scale.

Enhanced Security Features: Investing in advanced security features, such as biometric authentication, tokenization, and robust encryption, provides an opportunity to address security concerns. Providers that prioritize user data protection and privacy are likely to gain the trust of consumers and encourage broader adoption.

Integration with Emerging Technologies: Exploring the integration of emerging technologies, including blockchain and decentralized finance (DeFi), can open up new possibilities for third-party mobile payment services. These technologies can enhance transparency, reduce transaction costs, and enable innovative financial products.

About QYResearch

QYResearch founded in California, USA in 2007.It is a leading global market research and consulting company. With over 16 years’ experience and professional research team in various cities over the world QY Research focuses on management consulting, database and seminar services, IPO consulting, industry chain research and customized research to help our clients in providing non-linear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability. Up to now, we have cooperated with more than 60,000 clients across five continents. Let’s work closely with you and build a bold and better future.

QYResearch is a world-renowned large-scale consulting company. The industry covers various high-tech industry chain market segments, spanning the semiconductor industry chain (semiconductor equipment and parts, semiconductor materials, ICs, Foundry, packaging and testing, discrete devices, sensors, optoelectronic devices), photovoltaic industry chain (equipment, cells, modules, auxiliary material brackets, inverters, power station terminals), new energy automobile industry chain (batteries and materials, auto parts, batteries, motors, electronic control, automotive semiconductors, etc.), communication industry chain (communication system equipment, terminal equipment, electronic components, RF front-end, optical modules, 4G/5G/6G, broadband, IoT, digital economy, AI), advanced materials industry Chain (metal materials, polymer materials, ceramic materials, nano materials, etc.), machinery manufacturing industry chain (CNC machine tools, construction machinery, electrical machinery, 3C automation, industrial robots, lasers, industrial control, drones), food, beverages and pharmaceuticals, medical equipment, agriculture, etc.

English

Simon Lee

English

Hitesh

Chinese

Damon

Japanese

Tang Xin

Korean

Sung-Bin Yoon

Competition

Key players, new entrants,acquisitions, mergers and expansions,development trends and challenges.

Industry Analysis

Rawmaterial, application, product type, demand,supply,downstream, supply chain etc.

Market Size

Capacity, production, sales, revenue, price, cost etc.

Customized Information

We can offer customized survey and information to meet ourclient's need.