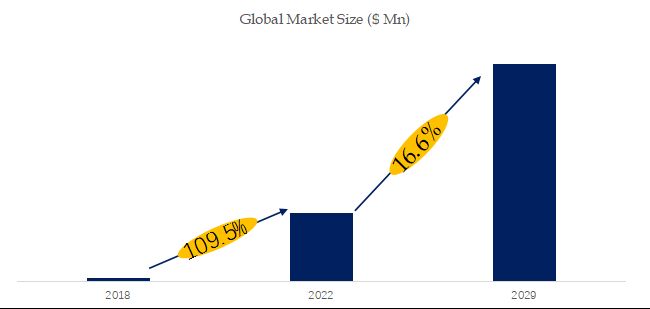

LiDFP Industry Analysis:the global market size is projected to reach USD 0.89 billion by 2029

According to the new market research report “LiDFP - Global Market Share and Ranking, Overall Sales and Demand Forecast 2024-2030”, published by QYResearch, the global LiDFP market size is projected to reach USD 0.89 billion by 2029, at a CAGR of 16.6% during the forecast period.

- Global LiDFP MarketSize(US$ Million), 2018-2029

Source: QYResearch, "LiDFP - Global Market Share and Ranking, Overall Sales and Demand Forecast 2024-2030”

Market Drivers:

D1: Policy assistance, electrolyte broad prospects. At present, under the background of the global automobile electrification wave, lithium power batteries reflect a high-speed, stable and robust demand, which drives the electrolyte industry to the tight production capacity, to the trend of oversupply and demand, which also leads to the electrolyte product prices continue to rise.

Electrolyte is the four key materials of lithium battery, both upstream chemical industry cycle attributes and downstream manufacturing long-term cost reduction requirements. Under the short-term demand outbreak and supply-demand mismatch, the industry's high prosperity is expected to continue in the next few years, and suppliers in all segments are expected to fully benefit.

Benefit from the rapid growth of the global electric vehicle and energy storage market, is expected to 2025 global lithium-ion battery electrolyte shipments of more than 1.3 million tons, the market size of nearly 40 billion yuan, compound growth rate of 32%. The electrolyte industry shows a trend of increasing concentration, and the proportion of head companies is increasing year by year.

D2: lithium hexafluorophosphate upgrade substitution. The state requires that future lithium batteries develop in the direction of higher safety and higher energy density, i.e., the safety requirements for electrolyte have increased significantly.

LiPO2F2 can significantly improve the performance of lithium batteries in terms of high and low temperature, cycle life and safety. This new electrolyte solvent with higher safety and stability is ushering in development opportunities.

D3: Mature lithium battery industry chain. After years of development, the overall industry chain of China's lithium battery has been very mature, for the additives industry, the upstream raw material processing industry has a complete range of products, mature production technology, quality and gradually improve the production capacity of abundant production. In the downstream electrolyte and lithium battery production industry, Chinese manufacturers have occupied most of the global market share, and have the ability to drive the rapid development of the whole industry chain.

Restraint:

R1: New energy vehicle sales less than expected, affecting electrolyte demand and profitability. Electrolyte additives terminal is mainly used in digital products and new energy vehicles, in the national policy to support the future incremental market mainly from new energy vehicles, the previous period in the context of the national subsidy policy of new energy vehicles showed high growth trend, but the future subsidies year by year downward and will eventually be canceled, the competitiveness of the new energy vehicles and the cost-effective will be particularly important, such as new energy vehicles to promote the less-than-expected, the electrolyte If the promotion of new energy vehicles is not as expected, the electrolyte additives and LiPO2F2 market size may be less than expected.

R2: electrolyte additives new capacity release is not as expected. One of the gaps between electrolyte and competitors' products is additive technology, electrolyte additives are technically difficult and demanding, and there are many uncertainties in industrialization, such as electrolyte additives new capacity release obstacles, profitability may be affected.

R3: High price constraints on the development of industrialization. Different kinds of new electrolyte solubility, corrosivity, synthesis difficulty, price, etc. are not the same, in the application process of the electrolyte performance of the impact of the electrolyte is also different, electrolyte manufacturers will consider the performance and price and other factors to choose the use of the new electrolyte, the industrialization of various types of new electrolytes to promote the majority of the initial stage. Due to the high production technology threshold, the price of new electrolyte LiPO2F2 is high at the beginning of application, which restricts the rapid industrialization of LiPO2F2.

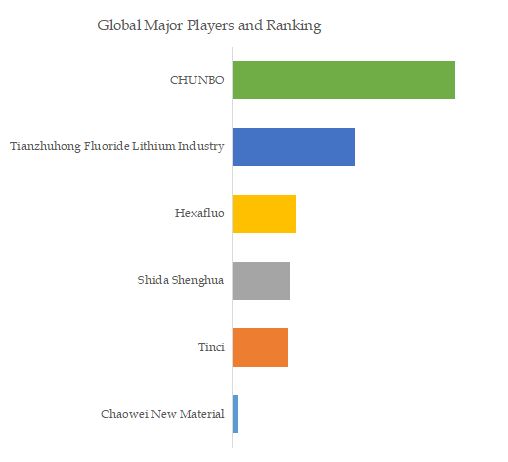

- Global LiDFP Top6Players Ranking and Market Share(Continually updated)

Source: QYResearch, "LiDFP - Global Market Share and Ranking, Overall Sales and Demand Forecast 2024-2030”

According to QYResearch Top Players Research Center, the global key manufacturers of LiDFP include CHUNBO, Tianzhuhong Fluoride Lithium Industry, etc. In 2022, the global top three players had a share approximately 67.0% in terms of revenue.

About The Authors

|

Jiang Jinxiu - Lead Author |

|

Email: jiangjinxiu@qyresearch.com |

|

Jinxiu Jiang is a technology & market senior analyst specializing in chemical industry. Jiang has rich research experience in chemical industry and focuses on perfluoropolyethers, lubricating greases and heat transfer oils, trichlorohydrosilicon, petroleum needle coke, zirconia beads, high-strength glass fibers, long-glass fiber reinforced polypropylene, isostearic acid and its derivatives, and polytetrahydrofuran, etc. She is engaged in the development of technology and market reports and is also involved in custom projects. |

About QYResearch

QYResearch founded in California, USA in 2007.It is a leading global market research and consulting company. With over 16 years’ experience and professional research team in various cities over the world QY Research focuses on management consulting, database and seminar services, IPO consulting, industry chain research and customized research to help our clients in providing non-linear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability. Up to now, we have cooperated with more than 60,000 clients across five continents. Let’s work closely with you and build a bold and better future.

QYResearch is a world-renowned large-scale consulting company. The industry covers various high-tech industry chain market segments, spanning the semiconductor industry chain (semiconductor equipment and parts, semiconductor materials, ICs, Foundry, packaging and testing, discrete devices, sensors, optoelectronic devices), photovoltaic industry chain (equipment, cells, modules, auxiliary material brackets, inverters, power station terminals), new energy automobile industry chain (batteries and materials, auto parts, batteries, motors, electronic control, automotive semiconductors, etc.), communication industry chain (communication system equipment, terminal equipment, electronic components, RF front-end, optical modules, 4G/5G/6G, broadband, IoT, digital economy, AI), advanced materials industry Chain (metal materials, polymer materials, ceramic materials, nano materials, etc.), machinery manufacturing industry chain (CNC machine tools, construction machinery, electrical machinery, 3C automation, industrial robots, lasers, industrial control, drones), food, beverages and pharmaceuticals, medical equipment, agriculture, etc.

Contact Us:

If you have any queries regarding this report or if you would like further information, please contact us:

QY Research Inc.

Add: 17890 Castleton Street Suite 369 City of Industry CA 91748 United States

E-mail: global@qyresearch.com

Tel: 001-626-842-1666(US) 0086-133 1872 9947(CN)

EN: https://www.qyresearch.com

JP: https://www.qyresearch.co.jp

English

Simon Lee

English

Hitesh

Chinese

Damon

Japanese

Tang Xin

Korean

Sung-Bin Yoon

Competition

Key players, new entrants,acquisitions, mergers and expansions,development trends and challenges.

Industry Analysis

Rawmaterial, application, product type, demand,supply,downstream, supply chain etc.

Market Size

Capacity, production, sales, revenue, price, cost etc.

Customized Information

We can offer customized survey and information to meet ourclient's need.